How the American Rescue Plan helped 6 million small businesses in its first year

Josh Axelrod, The American Independent

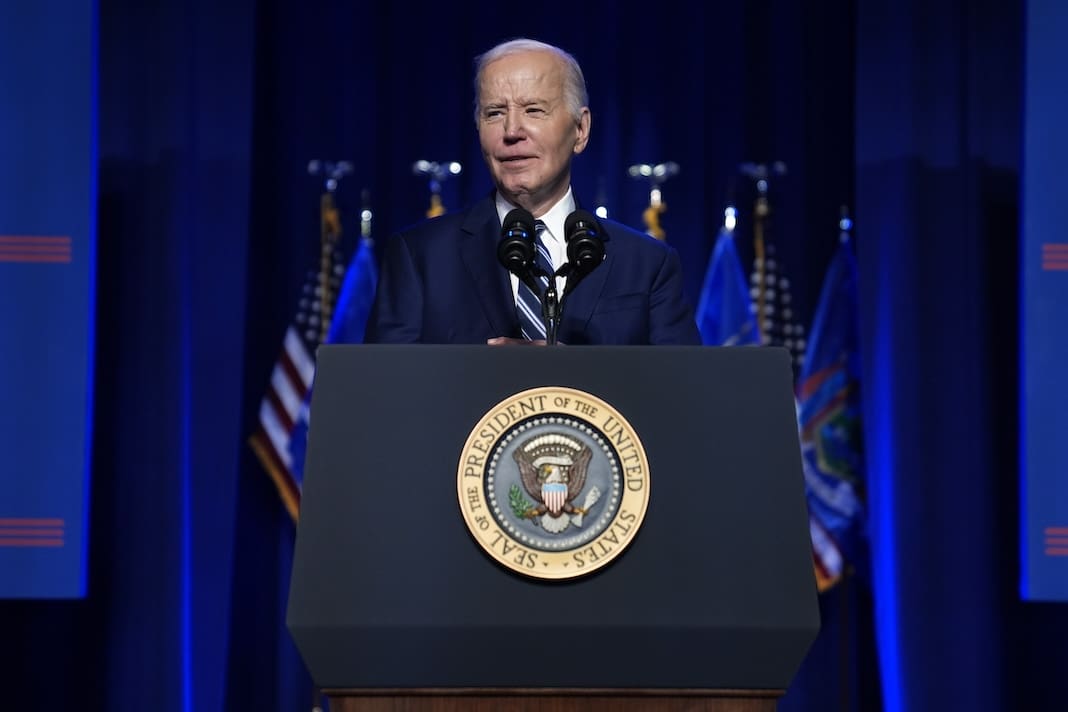

President Joe Biden’s stimulus package sent out more than $400 billion in funding to small-business owners to keep them afloat in the first year of his presidency.

Nearly one year ago, President Joe Biden muscled his landmark pandemic stimulus legislation through a Senate with a razor-thin Democratic majority, despite unanimous Republican opposition. The American Rescue Plan Act revitalized the economy and delivered billions of dollars to struggling small businesses, a new report from the nonprofit Invest in America details.

“Today, many small businesses have been able to stay afloat due in part to the aid delivered through the ARP,” Awesta Sarkash, government affairs director of the nonprofit Small Business Majority, said in a statement provided to the American Independent Foundation. “These targeted programs bolstered small businesses during difficult times and provided them with the funding they needed to persevere.”

The American Rescue Plan, which became law in March 2021 and allocated $1.9 trillion in federal funding for stimulus checks, unemployment payments, child tax credits, local emergency funding, and more, came at a pivotal time for small businesses, advocates said.

In February of last year, three out of 10 small businesses reported they wouldn’t be able to survive the next three months without immediate grant assistance, according to a survey from the Small Business Majority.

The American Rescue Plan also came with critical programs for small business owners like the Paycheck Protection Program, the Restaurant Revitalization Fund, and the Shuttered Venue Operators Grant.

The law allocated an additional $280 billion to the PPP loan program, which sent federally guaranteed, no-fee, forgivable loans to keep small businesses afloat by paying expenses like employee benefits, payroll, mortgage or rent payments, utilities, and COVID-19 safety equipment.

While the program was first created to support small businesses under President Donald Trump as part of the 2020 COVID relief law, the CARES Act, a Washington Post analysis of Small Business Administration data later showed that more than half of the money went to big businesses. Last year, however, 96% of PPP loans went to businesses with 20 or less employees, the Invest in America report shows.

Additionally, the Shuttered Venue Operators Grant sent out $13.4 billion to about 13,000 theaters and other venues last year to make up for their lost income due to closures during the pandemic.

And the Restaurant Revitalization Fund disbursed $28.6 billion to restaurants with the same goal in mind in 2021. By supporting more than 100,000 restaurants, the fund saved 900,000 workers their jobs, the National Restaurant Association estimated.

Of the restaurant grant recipients, 96% said it likely allowed them to stay in business during the pandemic, and 86% said it permitted them to keep or hire back employees who’d otherwise have been out of a job.

“[In the beginning of 2021], we were seeing a lot of small business owners lay off employees, and most small business owners will tell you that their employees are like family, so it was that much more dire,” Sarkash told the American Independent Foundation.

When the pandemic first hit in March of 2020, businesses took a huge blow to their revenues, with lockdowns keeping shoppers at home. But the toll was especially pronounced for small businesses, who were not as prepared to shift their services online or find ways to continue serving customers.

“You could own an independently owned bookstore or hardware store or toy store and you had to close, but somebody could go to Walmart to buy groceries and while there, they could buy books, they could buy clothes, they could buy hardware,” Kennedy Smith, a researcher with the advocacy organization Institute for Local Self-Reliance, told the American Independent Foundation.

Experts argue that keeping small businesses up and running is vital for the national economy. The Invest in America report links the ample funding provided to small businesses with a historic economic recovery, which some economists estimate happened at a rate eight times faster than after the Great Recession that ended in 2009. In 2021, the economy added 6.6 million jobs and 5.4 million new private businesses.

“During the shutdown, when people were not able to access their local businesses, I think that made them aware that their local businesses in their community had a huge role to play in keeping our economy afloat,” Derek Peebles, executive director of the American Independent Business Council, said in a phone call.

Now, as they mark the first anniversary of the American Rescue Plan’s passage, small business advocates want to see more action from Biden to support small businesses.

A few recommendations from Smith include comprehensive training programs for new business owners; affordable operating space; child care services for owners and employees; and minority-owned business development programs to close the racial entrepreneurship gap.

“[The American Rescue Plan] at least helps make small businesses whole from the damage they suffered during the pandemic, but it doesn’t do a lot to change the overall environment for small business development,” Smith said.

Smith and other small business advocates want continued investments in recognition of small businesses’ central role in American civic life.

As Chanda Causer, co-executive director of the organization Main Street Alliance, told the American Independent Foundation: “This investment in sustaining those businesses, it’s an investment in the next generation. It’s an investment in education and civic life, our public systems, our firefighters — without those things our ecosystem starts to fall apart.”

Published with permission of The American Independent Foundation.