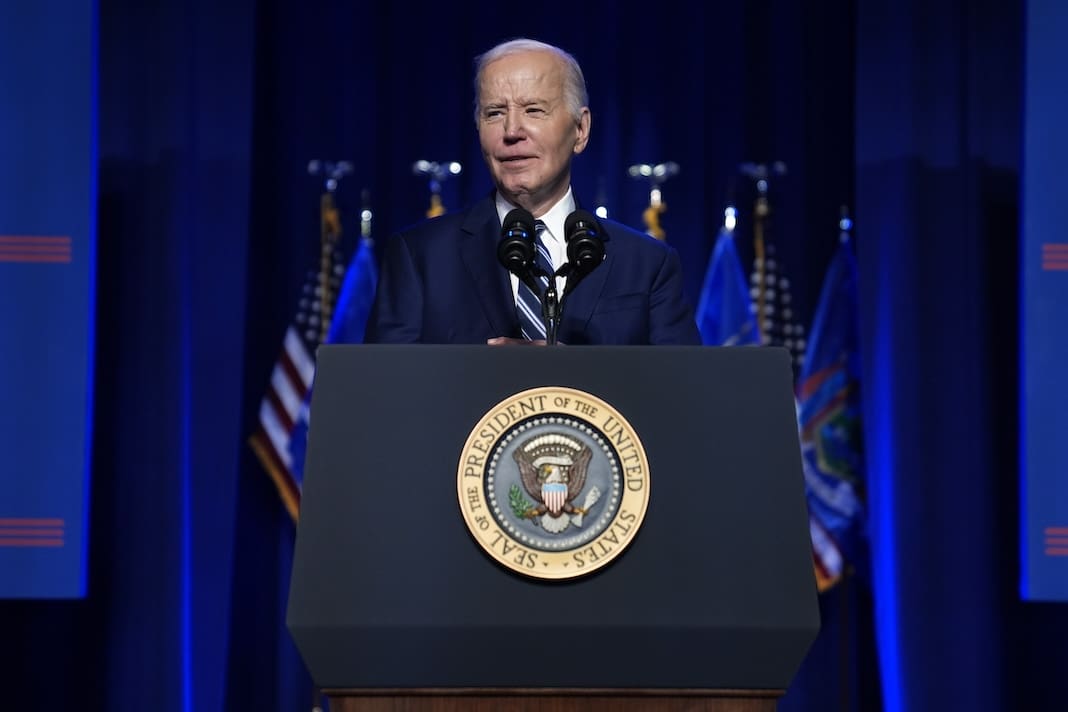

Biden administration launches probe into private equity’s impact on health care

Michigan doctors have expressed concerns that investor ownership of health care facilities could endanger patients.

The Department of Justice, the Department of Health and Human Services, and the Federal Trade Commission jointly announced on March 5 that they have launched an inquiry into the effect private equity ownership is having on health care.

In the last few years, private equity firms have become increasingly involved in the health care industry by taking over hospitals, nursing homes, and other medical facilities. According to the Commonwealth Fund, a foundation that deals with health care issues, equity firms have spent more than $1 trillion on these acquisitions over the last decade.

The new inquiry will investigate whether these actions have led to consolidation of the medical industry at the expense of patient health and safety, as well as the impact on doctors, nurses, and other medical professionals.

The agencies have released a request for comment, asking the public to submit information on related health care deals that may warrant further investigation.

“We need to do more to understand the impact of private equity and corporate dealmaking on our policymaking, regulatory decisions and enforcement actions. The Biden-Harris Administration is committed to improving transparency and competition in health care,” Health and Human Services Secretary Xavier Becerra said in a statement.

Several nonprofit medical societies in Michigan have expressed concern over private equity activity in the medical sector.

In October, the Michigan State Medical Society, the Michigan College of Emergency Physicians, the Michigan Dermatological Society, the Michigan Orthopaedic Society, and several other groups sent a letter to Attorney General Dana Nessel requesting an investigation of medical practices owned by doctors “in name only.”

The groups noted that Michigan law prohibits private unlicensed for-profit businesses from owning medical practices and alleged that private equity firms are in violation of the law.

In a letter addressed to members of the state medical society, Tom George, its CEO, wrote: “Michigan, like many other states, has a CPOM [corporate practice of medicine] doctrine specifically intended to protect the public by prohibiting unlicensed, for-profit businesses from practicing medicine here in our state. The problem is these laws are poorly enforced, and as a result, for-profit entities have taken advantage. Through a series of deceptive legal loopholes and shell corporations, equity investors are increasingly circumventing Michigan law and putting the health and well-being of Michigan’s patients in jeopardy in the process.”

As an example, the groups’ letter to Nessel noted that the medical staffing firm TeamHealth, which operates in Michigan, was the subject of a ProPublica investigation in 2020. That expose found that TeamHealth, owned by the private equity firm Blackstone, had significantly inflated medical bills to pad the company’s bottom line.

Additionally, a study published in December 2023 in the Journal of the American Medical Association found that Medicare patients in hospitals owned by private equity firms were more likely to experience falls and bloodstream infections, which it said suggested poorer quality of care. A July 2023 study published in The BMJ (formerly the British Medical Journal) found a correlation between private equity acquisitions of health care facilities and increased costs for patients.

The Biden administration has already taken action to address private equity’s involvement in medicine. In September 2023, the FTC sued the firm U.S. Anesthesia Partners and the private equity firm Welsh, Carson, Anderson & Stowe. The agency alleged that the two companies worked in concert to monopolize anesthesia services in Texas and artificially increased prices to boost their profits.Both companies have denied the FTC’s claims, and the case is still pending.